Power and utility companies have long been vital to developing and operating our critical infrastructure. Over the next decade, we believe they will continue to do so, but the nature of their roles in the energy ecosystem is poised to evolve. We are seeing the industry shift from a distribution system served by highly centralized generation resources with business decisions largely focused on pursuing economies of scale to one that is becoming far more decentralized. This decentralization trend will likely persist and accelerate in the future, further necessitating the evolving role of utilities as the platform from which disparate (and increasingly numerous) energy players can integrate new energy products and services — even those not produced by the utilities themselves.

While there may be new entrants in the energy market that operate at the fringe of the utility value chain, it’s clear that the nerve center of our ever-changing society is powered by traditional pipes and wires. Clearly, this critical infrastructure will require continuous innovation and investment to meet the demands of the “new normal.” The fact remains that the traditional utility is the single and most well-equipped institution to accept and meet the challenging emerging social changes, including greater urbanization and staggeringly swift technological advancements. Companies not embracing this new role may risk disintermediation from their customers, by incremental degrees and over the years, as new entrants exert control in new energy product-and-service markets. Those who see this role as the opportunity that it is, will be best positioned to successfully emerge on the other side of this evolution.

We believe the industry holds the key to defining its own future, instead of letting external forces define it for them. It starts with embracing disruption and placing bets on new ways to be more relevant to society, in an expanded role that we’re calling The Utility Platform Player.

The future of the industry hinges on what companies are doing now to shift toward becoming a Utility Platform Player, or the connective tissue, enabling a decentralized, digitally driven energy ecosystem of the future.

Naturally, there’s no one-size-fits-all path toward this future. There are numerous ways to grow — from continuing to foster a new customer-centric, innovative mindset and embracing new partnerships to becoming more digitally-connected across all aspects of the value chain and enabling new entrants to join and profit from the energy ecosystem. Power and utility companies have to choose where they want to play, so to speak. Where do they want to be the provider and where do they want to be the enabler? Neither choice is wrong, as different decisions may be driven by external factors such as regulator preferences, stakeholder investment and regional needs, in addition to strategic decisions. Either path demonstrates an active decision to be more of a player in the broader energy ecosystem, making strategic bets that move the industry forward.

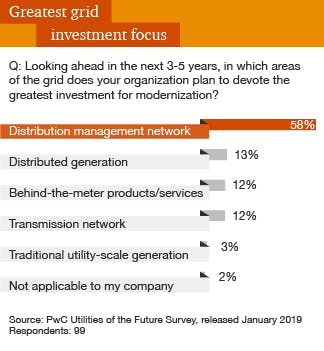

As power and utility companies strive to modernize, they are faced with a choice: Where to focus the attention? With sweeping changes in the industry often occurring closer to the customer edge in the grid, it’s not surprising that the greatest focus of modernization efforts seems to be at the distribution side of the network, according to PwC’s survey of more than 130 senior gas, electric, water and renewable professionals across the United States in both regulated and deregulated markets. In fact, we found that a majority of those surveyed, about 60%, plan to place the lion’s share of their investment dollars on improving the distribution management network. Nearly all have already implemented advanced metering infrastructure and monitoring systems (or have plans to do so) — investments that are essential to building a “digital bridge to customers."

Modernization efforts are creating the opportunity to become the platform provider for a bevy of services now offered by new entrants in the energy economy. As utilities gain a sharper and more granular understanding of their customers’ needs, preferences, values and habits, they are better positioned to make the right bets on which products and services their grids need to support.

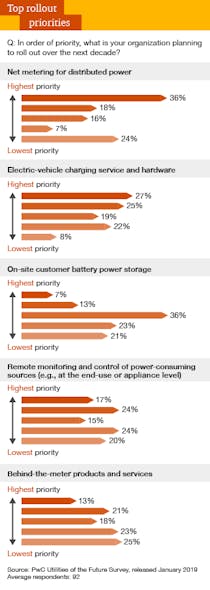

According to our survey, when asked which services (and products delivering those services) they plan to roll out over the next decade, a few stand-outs emerged. The most pressing needs centered around net metering solutions for distributed power (around which business models are still very much in flux) as well as electric vehicle (EV) charging service and hardware. Our findings also showed that the third most urgent roll-out — remote monitoring and control of energy use (at the end-us or appliance level) — reveals that utilities are responding to customers’ demand for control and choice in their energy use in ways they never have before.

Meanwhile, power and utility companies have a responsibility that other industries do not: providing efficiencies and digital advances, while at the same time maintaining the safe, reliable and economical service to which customers have become accustomed. As industry professionals report, another factor complicates the equation — that is, having a diverse set of stakeholders, including regulators.

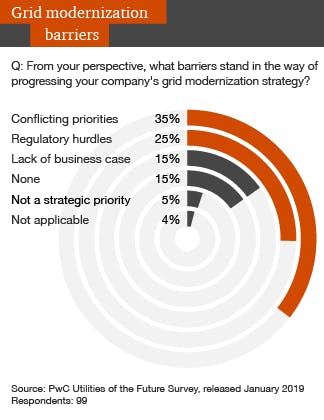

While 15% reported no challenge in implementing strategies in this area, others reported barriers standing in the way of progressing grid modernization strategies, with conflicting priorities and regulatory hurdles rising to the top. Carrying out a five or 10-year grid modernization plan will undoubtedly require gaining consensus on strategy — both across the organization internally as well as among a broad range of external constituencies, including customers, consumer advocates, regulators, community leaders and public officials, and governmental bodies.

By embedding themselves at the core of grid modernization, utilities will not only generate potentially new revenue opportunities, but also solidify their central roles as platform providers and thus stave off competition from other emerging companies entering the energy space (communications, IoT, EV charging, storage, connected products, apps, and so forth). For example, utilities are well-positioned to be the central platform and, counterintuitively even take ownership of “off-the-grid” pursuits, including EV charging deployment, battery storage maintenance and even the aggregation of power from disparate sources (car and home batteries and home solar).

Power and utility companies are poised to become an even more vital player in the energy ecosystem of tomorrow. We believe the industry holds the key to making it happen provided that companies take ownership of these various platforms integral to grid modernization, and not cede control to other industries and new start-ups eager to enter the energy market. There are many paths forward, but at the core is the ongoing need to get the right people, with the right skills and experience, to succeed in this ever-changing world.